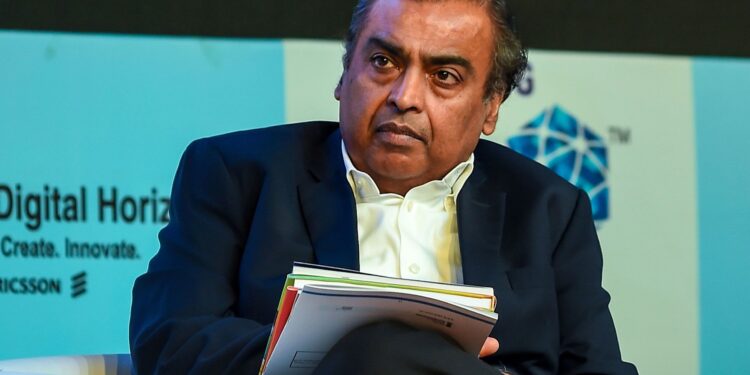

An Indian billionaire, Mukesh Ambani is poised to challenge MTN and other telecom companies in Africa as he gears up to venture into the continent through a telecommunications initiative. The goal is to capture the attention of mobile broadband users in a market that is experiencing rapid growth.

Radisys Corp., a subsidiary of Reliance Industries Ltd., which is controlled by Ambani, has been selected to supply essential network infrastructure, applications, and smartphones for Next-Gen InfraCo., a company based in Ghana. Harkirit Singh, the executive director of NGIC, revealed these details before the official launch announcement of NGIC in Mumbai, India’s prominent financial center.

READ MORE: Will US SEC Investigate OpenAI CEO Altman And Microsoft’s Nadella?

NGIC, a company set to commence operations by the conclusion of this year, aims to offer 5G broadband services to mobile operators and Internet service providers in Ghana.

The company “is based on a premise of building affordable digital services in emerging markets”, Singh said.

Other strategic partners in NGIC include Nokia, Indian outsourcer Tech Mahindra, and Microsoft, which has increasingly sharpened its focus on the telecoms business following an acquisition of two cloud networking firms in 2020.

Ghana, a nation in West Africa with a population slightly exceeding 33 million, is served by three primary operators: MTN Ghana, Vodafone Ghana, and the government-owned AirtelTigo. According to Singh, NGIC’s strategic alliances, advanced technology capabilities, and exclusive possession of Ghana’s sole 5G license position it well to establish widespread broadband services, a significant investment typically challenging for individual mobile service providers.

According to Singh, two African telecoms firms, Ascend Digital Solutions, and K-NET hold a combined stake of 55 percent in the new company.

Singh who is also the chief executive of Ascend also revealed that the Ghana government will own just under 10 percent of NGIC, while local mobile operators and private investors will retain the remaining shares in the firm.

NGIC has the exclusive right to offer 5G services in Ghana for a decade, though its license is valid for 15 years. The company’s capital expenditure for three years is US$145 million, according to Singh.

What The Company Hopes To Achieve By Making Its Way To Africa

The company is seeking to mirror the success of Ambani’s Jio Infocomm in India. Jio entered the telecommunications market in India in late 2016, providing affordable data and free voice calls, resulting in the closure of some competitors and the consolidation of others. It is widely recognized for making mobile data affordable for hundreds of millions of Indians. Jio is currently the largest mobile operator in India with 470 million users.

NGIC will provide “affordable mobile broadband services and devices to the people of Ghana, replicating the success of India’s low-cost mobile data revolution,” Ghana’s Minister for Communications and Digitalization Ursula Owusu-Ekuful said.

The Reliance-NGIC partnership is also a diplomatic win for India, which has sought to counter China’s surging influence in Africa via measures such as digital inclusion.

None of the strategic partners, including Reliance, currently own any equity in NGIC. But the company will give them an option to accept part of their payments as equity in the future, Singh said.

“First we have to be successful to show the value that we create before they come in,” Singh said. “That’s the discussion we are having with them.”

More Insights

Radisys Corp is a subsidiary of Indian billionaire Mukesh Ambani-owned Reliance Industries. Reliance Industries is the largest private-sector company in India. It is involved in the oil refining, petrochemical, gas, retail, textile businesses, and now Telecommunications business.

Ghana’s NGIC entering a partnership with Radisys Corp has secured exclusive rights to offer 5G services in Ghana for up to a decade, with license extending to up to 15 years.

The Nigerian Telecommunication industry is plagued by poor internet services, even though it purports to offer 5G, prompting consumers to seek out new options such as Elon Musk’s Starlink and local Internet providers like FibreOne.

The Intensifying Battle For Africa’s Telecom Market

Before Ambani disclosed that his company was looking to venture into the telecoms business in Africa, there had been escalating competition in Africa’s telecommunications sector.

Airtel and MTN are two of the largest telecommunications companies in Africa, and their rivalry is fierce. The two companies are constantly competing for market share, customers, and investment.

From the very beginning, both companies have contended toe-to-toe for revenue, for-profit, and a customer base, rivaling the peak of Africa’s telecom space.

President of the National Association of Telecommunication Subscribers once revealed that; “the rivalry between this telecom giant is a scramble for subscribers, they want more subscribers on their various networks, but it’s a healthy competition,”

Meanwhile, this fierce competition is not limited to Nigeria but extends across the African continent.

MTN has expanded its mobile money services to numerous African countries, including Ghana, South Africa, Kenya, and Uganda. Airtel has also made significant inroads, operating in countries like Zambia, Malawi, Tanzania, and Rwanda.

Airtel’s focus on its remains in areas where they can control the provision of reliable telecom and mobile money services at affordable rates across its 14 sub-Saharan markets in Africa where demand for these services remains significant.