The recent enforcement measures on cryptocurrency by the Nigerian government, particularly its focus on Binance, have led professionals and investors in the industry to express their hesitancy towards investing in the West African nation.

Bitcoin News reports that the increased scrutiny on Binance and other cryptocurrency platforms has prompted crypto companies to reassess their intentions of entering or expanding their investments in the West African nation.

The enforcement action, initiated a few months subsequent to the Central Bank’s removal of an indirect prohibition on Crypto, was viewed by Crypto enterprises and investors as a backward measure for Nigeria.

The Nigerian government recently detained two Binance executives accusing the crypto exchange of tax evasion. Although Binance has shown willingness to work with the Nigerian government it has vehemently refused to release names of top Nigerian users.

The Nigerian government, struggling with the depreciation of its domestic currency, has attributed currency manipulation to crypto exchanges such as Binance. This conflict resulted in Binance discontinuing its services in Nigeria, with the Nigerian government directing local telecoms to restrict access to crypto exchanges within the nation.

While the Naira seems to have improved after the crackdown Crypto experts and investors say the entire episode has left a bitter taste in their mouths as regards investing in the country.

A founder of a cryptocurrency exchange stated that the crackdown on Binance raises questions about the fundamental rule of law necessary for any society to function effectivel

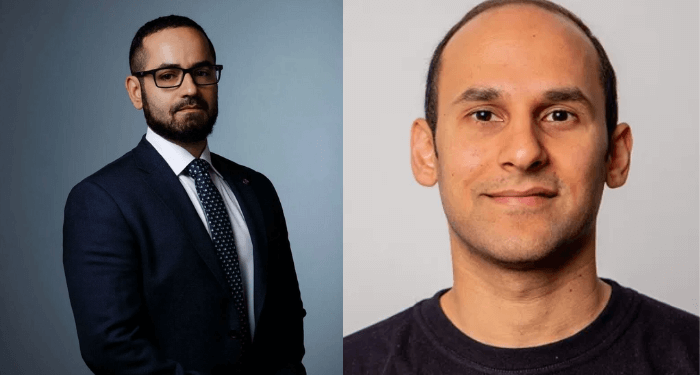

Farzam Ehsani, Valr’s Co-founder and CEO, a leading crypto exchange in Africa, elaborated on how the measures taken against Binance have repercussions that go beyond merely impacting the trust of cryptocurrency investors.

As of today, some Binance executives in Nigeria have been charged with what seem to be spurious allegations which is a very worrying state of affairs that has ramifications far beyond the crypto industry in Nigeria: What has transpired calls into question the very fundamental rule of law that is required for any society to function effectively,” Ehsani asserted.

Several individuals within the African cryptocurrency industry express the same dissatisfaction as the CEO of Valr.

However, there are also opposing opinions that support the Nigerian government’s stance, asserting that the country aims to find a harmonious equilibrium between innovation and regulation.

Leona Hioki, the cofounder of the Ethereum Layer 2 Platform, Intmax is one of such voices citing how the company invested in Nigeria despite the news of the crackdown on Binance.

Some friends even advised us against going at such a time, especially since we arrived in Nigeria just two weeks after the news about Binance broke. [However], we recognize that the Nigerian government is actively working to strike a balance between innovation and regulation,” the Intmax CEO said.

Hioki, similar to the CEO of Valr, recognized that Nigeria possesses significant potential for cryptocurrency. It is imperative for crypto firms and investors to collaborate with the Nigerian government in order to establish a balanced approach that facilitates smooth operations.

You Also Need To Know That…

The Nigerian government detained two Binance executives and charged Binance, the world’s largest Crypto exchange with Tax evasion. One of the detainees escaped from custody but was still tried in Absentia.

According to the Africa Report, a Crypto firm said Nigeria is one of the only six countries in the top 50 by size globally whose crypto transaction volume grew year-over-year in the period they studied. The firm also said the volume of crypto transactions in Nigeria grew 9% to $56.7bn between July 2022 and June 2023.