The Central Bank of Nigeria (CBN), has disclosed that dollar inflow into the country’s economy surged more than fourfold in February to $1.3 billion.

The majority of this inflow was stated to have come from diaspora remittances and proceeds from government securities purchased by foreign portfolio investors.

Hakama Sidi Ali, the acting director of CBN Corporate Communications, made this disclosure in Abuja, where she highlighted that the inflow trend has persisted into March.

The central bank reported a significant increase in foreign exchange inflow into the economy in February 2024, with marked increments in remittance payments by Nigerians overseas and purchases of naira assets by foreign portfolio investors.

The Bank’s data indicates that overseas remittances rose to US$1.3 billion in February 2024, more than four times the $300 million received in January.

Foreign investors purchased more than US$1 billion of Nigerian assets last month, with total portfolio flows of at least US$2.3 billion recorded thus far in 2024 compared to US$ 3.9 billion seen in total for last year,” she added.

What’s CBN doing to curb alarming inflation?

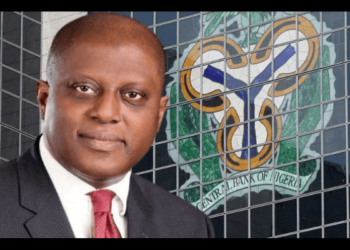

CBN Governor, Yemi Cardoso had outlined a comprehensive strategy during the recent Monetary Policy Committee (MPC) meeting and a conference call with foreign portfolio investors. The strategy, according to him, aims to address inflation, stabilize the exchange rate, and enhance confidence in the banking system and economy.

The central bank sets expectations for sustained growth in Nigeria’s foreign currency reserves and improved liquidity in the foreign exchange market.

All the different measures we have taken to boost reserves and create more liquidity in the markets have started to pay off.

When people understand the real issues and see a strategy and a plan, things tend to calm down. Our objective today is to ensure that the market has supply, that the market functions, and that investors can come in and go out,” he noted.

What dollar inflow into Nigeria means

The influx of dollars injects much-needed liquidity into Nigeria’s forex market, potentially stabilizing or even appreciating the naira against the dollar. Businesses reliant on imports may benefit from lower import costs, while individuals needing dollars for foreign transactions could find better rates.

The increased access to dollars can stimulate economic activity, allowing businesses involved in international trade to resume or expand operations. This could lead to increased investment, job creation, and overall economic growth.

Meanwhile, understanding the source of this increase is crucial for predicting its sustainability. Addressing underlying structural challenges, such as Nigeria’s dependence on oil exports and large import bills, is essential for long-term currency stability. Diversifying the economy and promoting non-oil exports are key strategies.

The role of the central bank in managing the forex market is, however, pivotal. Continued intervention strategies and policies will heavily influence the sustainability of this positive trend.

Meanwhile, financial experts had advised the Nigerian government on how to stabilize the naira against dollar.

Amongst the analysts was -the Group Managing Director of Cowry Asset Management Company, Johnson Chukwu, and The Head of Strategy at the Lagos Business School, Prof Olawale Ajai, who stated that ramping up the country’s crude oil production and sales is the silver lining to the nation’s forex crisis.

Chukwu mentioned that Nigeria’s approach of tapping into the Eurobond Market for a loan could have been beneficial. However, he emphasized that the country is currently burdened with debts.

But as it stands today (Saturday), that window is narrow because we do not have the headroom for significant borrowing from the Eurobond market.

I think the short route for now in our country is to improve crude production. That is the surest way to stabilize the Naira, -he said in a statement.

Expressing his viewpoint, Prof Ajai stressed the necessity for the country to enhance its oil production to boost its earnings.

Also, we need to urgently increase the production of crude because if the government can earn more dollars from an increased daily production, then people can see the money coming in -he stated.