Nigeria’s Central Bank has succumbed to pressure as it has announced the suspension of the controversial cybersecurity levy. The financial institution emphasized that the policy is currently under thorough examination and review.

The circular mandating banks and payment service providers to collect and remit the cybersecurity levy, as proposed in the Cybercrime Prevention and Prohibition Amendment Act of 2024, has been withdrawn by Apex Bank.

The Cybersecurity Act was amended in 2024 and the scope of the levy was extended to cover fintechs, payment service providers, and other financial institutions and introduced a 900% increase from 0.005%.

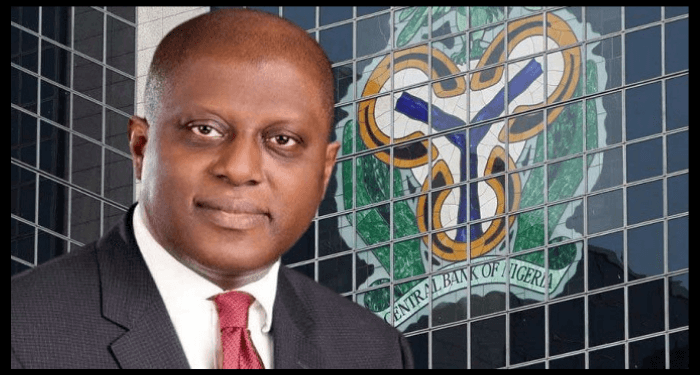

This latest development was announced via a statement signed by Haruna Mustafa, Director, of the Financial Policy and Regulation, Department, and Chibuzo Efobi, Director, of the Payment System Management Department.

READ MORE: What Dangote, Others Said about Late Wigwe

The circular stated: “The Central Bank of Nigeria circular dated May 6, 2024 (Ref. PSMD/DIR/PUB/LAB/017/004) on the above subject refers. ‘

The Minister of Information and National Orientation, Mohammed Idris also while briefing State House correspondents after the Federal Executive Council meeting in Abuja, said;

The position of the government is that that policy has been suspended. It has been put on hold. That is the position of the government for now. It is undergoing some form of review. It was reiterated in the council (FEC meeting) yesterday.

You know that today’s council (meeting) is a continuation of the council meeting of yesterday. So, I can tell you that the cybersecurity levy has been put on hold. It is being reviewed by the government

The withdrawal follows the decision of the Federal Executive Council to suspend the implementation of the provisions of the law citing the need to conduct further reviews.

More

Financial industry experts criticized the cybersecurity levy as “regressive” because of the significant rise in the cost of electronic transactions during a period of the country’s highest inflation rate in thirty years and a cost of living crisis. In response to increasing pressure from labor unions, the federal government decided to suspend the levy and announced that it would undergo a review on Tuesday.

The now-revoked cybersecurity levy entailed that an electronic transfer of ₦1,000 would incur a fee of ₦5, whereas a transfer of ₦100,000 would incur a fee of ₦500.

The levy would have incurred alongside a stamp duty fee, an SMS fee, and a fee from the national payment switch. A ₦10,000 electronic transaction levy would have amounted to ₦130.875. However, there were certain exemptions such as money transfers within the same bank, salary payments, school fees payments, and loan repayments.

Backstory

Recall, on May 6, 2024, the CBN through a circular ordered commercial banks, Payment Service Providers, and others to begin collection and remittance of 0.5% of the transaction cost of electronic transactions as a cyber security levy in line with the provisions of the amended 2024 cybercrimes prohibition and prevention act.

- In addition, the central bank has issued a warning that failure to comply will result in penalties as outlined in the amended Cyber Crimes Prohibition and Prevention Act. These penalties include a fine amounting to no less than 2% of the turnover of the defaulting business, along with other sanctions.

- The imposition of the levy has provoked frustration among Nigerians who have criticized the timing as inappropriate and the additional costs it imposes on businesses operating in the country. The Centre for the Promotion of Public Enterprise (CPPE) has warned that the new levy may exacerbate inflationary pressures and impede business development throughout the nation.

- The Nigerian Association of Chambers of Commerce, Industry, Mines, and Agriculture (NACCIMA) has further urged the Federal Government and the Central Bank of Nigeria (CBN) to set a maximum limit of N500 for the newly introduced cybersecurity levy, to alleviate the financial burden on the private sector.

- In response to the criticisms and complaints of Nigerians, the federal government through the Minister of Information announced the suspension of the levy pending some form of review in the future. The federal House of Representatives also called for the suspension of the levy even though they passed the amendment act that introduced it.