The newly-imposed cybersecurity levy has been met by disapproval from many Nigerians, who expressed belief that such policy would compel them to revert to cash-based transactions.

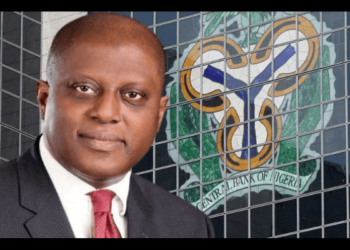

The Central Bank of Nigeria (CBN) had instructed financial institutions in the country to initiate the deduction process for the cybersecurity levy, which it noted would be administered by the Office of the National Security Adviser (NSA).

Nigerians, who are already burdened by the escalating cost of living crisis, vehemently opposed the cybersecurity levy, which is expected to be applied at the point of electronic transfer origination, and then deducted and remitted by the financial institution.

READ MORE: Will US SEC Investigate OpenAI CEO Altman And Microsoft’s Nadella?

The deducted amount shall be reflected in the customer’s account with the narration, ‘Cybersecurity Levy’.

Fintech Telex understands that the cybersecurity levy is a result of the passing of the 2024 Cybercrime (Prohibition, Prevention, etc.) Amendment Act, requiring a 0.5% reduction from the total amount of electronic transactions. The funds collected from this tax are designated for the National Cyber Security Fund, managed by the NSA’s office.

The ongoing discussion on the cybersecurity levy highlights the wider issues confronting the Nigerian economy, such as inflationary pressures and the importance of robust cybersecurity measures. As the cost of living continues to rise, the introduction of new levies has sparked renewed demands for fiscal responsibility and transparency from government officials.

Reactions

Several Nigerians have resorted to utilizing social media platforms as a means to voice their discontent regarding the levy, emphasizing the financial burden it will impose upon them.

Here are their reactions below;

A user on the X microblogging platform, Sarki, wrote: “In a country plagued by hardship, poverty, & unemployment, the Federal government has introduced new cyber security levies”.

Lola Okunrin, another user, noted that “Cybersecurity Levy in a country where it’s looking like bank staff are giving out our banking details to scammers. Our cyberspace is not secure at all and we are getting charged for it,”

_Enemali opined that; “The CBN cannot be encouraging a cashless economy then go ahead to reap customers of every kobo they have all in the name of taxes. The multiple taxation being experienced in the banking sector must stop. If government need more money. They should cut down their reckless expenditures.”

“This matters when it touches the middle class because the upper and lower classes of society won’t be affected much. The upper class can afford to pay it comfortably because they’ve multiple sources of income, while the lower class deals mainly with physical cash.

”But the middle class is where the real impact is felt. We can’t all just be comfortable paying an extra 0.5 percent on the money we’re working so hard without understanding how it improves our lives and the economy at large,” he said.

Usman Shamaki said that the move will prevent Nigerians from adopting the cashless banking policy introduced.

“Policy implementation in Nigeria is so topsy-turvy. You want people to embrace cashless banking. Rather than incentivise them to do so, you create penalties that hinder the acceptance of cashless banking. What exactly is the point of this 0.5 percent cybersecurity levy?” he stated.

Akuabatalum; “On the actual percentage of the Levy, if the Act says 0.005%, why is CBN imposing 0.5%? From my math knowledge, I am aware that 0.005 is not the same as 0.5 and the latter is higher. Either it is an error from the CBN or an exaggeration of the prescribed Levy by the Law.”

SERAP’s Reaction

In its intervention, the Socio-Economic Rights and Accountability Project (SERAP) and the Nigeria Labour Congress have called for the withdrawal of the directive.

In a statement issued by Kolawole Oluwadare, Deputy Director of SERAP, the organization called on President Bola Tinubu’s administration to retract the “arbitrary and illegal directive” issued by the CBN within 48 hours.

SERAP also urged the administration to halt Nuhu Ribadu and the Office of the National Security Adviser (NSA) from enforcing section 44 and other oppressive clauses of the Cybercrimes Act 2024.

These measures blatantly contravene the Nigerian Constitution, the African Charter on Human and Peoples’ Rights, and the International Covenant on Civil and Political Rights, all of which Nigeria is a signatory to, the organization said.

“If the unlawful CBN directive is not withdrawn and appropriate steps are not taken to amend the repressive provisions of the Cybercrimes Act within 48 hours, SERAP shall consider appropriate legal actions to compel the Tinubu administration to comply with our request in the public interest.

“Withdrawing the unlawful CBN directive and repealing the repressive provisions of the Cybercrimes Act 2024 will be entirely consistent with President Tinubu’s constitutional oath of office requires public officials to uphold the provisions of the constitution, and the rule of law and abstain from all improper acts,” the statement read in parts.

Backstory

There was a major shortage of cash for much of 2023 after the CBN introduced currency reforms intended to cut fraud in last year’s election. This pushed many people to start using mobile money.

The shortages only eased at the end of last year.

Only about eight percent of people aged between 16 and 64 have used mobile payment services in 2024. This was a decrease from the previous year.

Digital penetration is low in Nigeria due to the lack of mobile signal in many rural areas, while many people cannot afford smartphones.